Floyd and Merriam start a partnership business on 12 June 2019.Their capital account balances as of 31 December 2020 stood as follows:

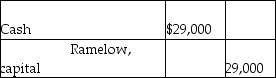

They agreed to admit Ramelow into the business for a one-fifth interest in the new partnership.He had to bring in a cash contribution of $29,000 for the same.Assuming that Floyd and Merriam shared profits and losses in the ratio 3:1 before the admission of Ramelow,which of the following is the correct journal entry to record the above admission?

A)

B)

C)

D)

Correct Answer:

Verified

Q41: When a new person wishes to be

Q42: Ruby and Anita are partners.Ruby has a

Q43: When a new partner pays a bonus

Q44: When a new person wishes to join

Q46: A new partner may be admitted to

Q48: Keith and Jim are partners.Keith has a

Q51: Sarah and Jane formed a partnership with

Q54: Rex and Sandy are partners.Rex has a

Q59: When a new partner pays a bonus

Q60: Keith and Jim are partners.Keith has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents