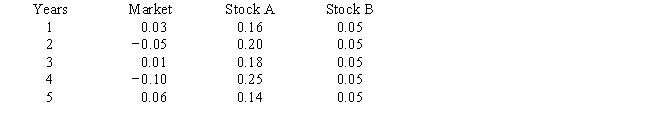

Consider the following average annual returns for Stocks A and B and the Market. Which of the possible answers best describes the historical betas for A and B?

A) bA > +1; bB = 0.

B) bA = 0; bB = −1.

C) bA < 0; bB = 0.

D) bA < −1; bB = 1.

E) bA > 0; bB = 1.

Correct Answer:

Verified

Q7: A stock with a beta equal to

Q33: Any change in its beta is likely

Q35: Portfolio A has but one security, while

Q39: The distributions of rates of return for

Q45: If markets are in equilibrium, which of

Q45: You are considering investing in one of

Q53: If the price of money (e.g., interest

Q54: Which of the following is NOT a

Q59: Since the market return represents the expected

Q60: Stock A's beta is 1.7 and Stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents