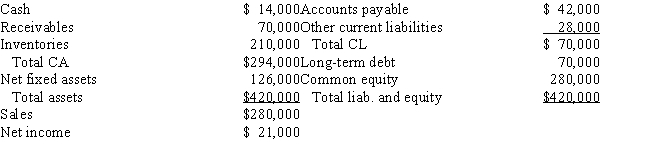

Muscarella Inc. has the following balance sheet and income statement data: The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average, 2.70, without affecting either sales or net income. Assuming that inventories are sold off and not replaced to get the current ratio to the target level, and that the funds generated are used to buy back common stock at book value, by how much would the ROE change?

A) 4.28%

B) 4.50%

C) 4.73%

D) 4.96%

E) 5.21%

Correct Answer:

Verified

Q5: High current and quick ratios always indicate

Q16: One problem with ratio analysis is that

Q21: The times-interest-earned ratio is one, but not

Q27: Heaton Corp.sells on terms that allow customers

Q28: The inventory turnover ratio and days sales

Q31: Harper Corp.'s sales last year were $395,000,

Q32: Debt management ratios show the extent to

Q35: Other things held constant, which of the

Q36: Arshadi Corp.'s sales last year were $52,000,

Q40: The inventory turnover and current ratio are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents