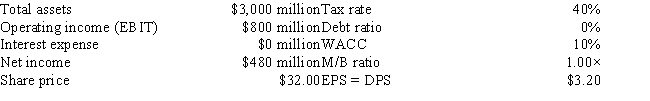

The following information has been presented to you about the Gibson Corporation. The company has no growth opportunities (g = 0) , so the company pays out all of its earnings as dividends (EPS = DPS) . The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%. If the company makes this change, what would be the total market value (in millions) of the firm?

A) $3,200

B) $3,600

C) $4,000

D) $4,200

E) $4,800

Correct Answer:

Verified

Q49: Bailey and Sons has a levered beta

Q53: Serendipity Inc.is re-evaluating its debt level.Its current

Q55: Cartwright Communications is considering making a change

Q61: Merriwether Building has operating income of $20

Q62: Pennewell Publishing Inc. (PP) is a zero

Q63: Which of the following statements is CORRECT?

A)

Q64: Companies HD and LD have identical tax

Q67: Best Bagels, Inc. (BB) currently has zero

Q68: Two operationally similar companies, HD and LD,

Q78: Firms U and L both have a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents