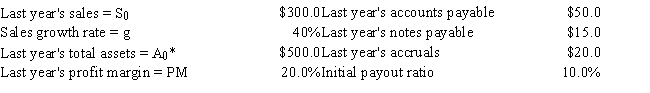

You have been asked to forecast the additional funds needed (AFN) for Houston, Hargrove, & Worthington (HHW) , which is planning its operation for the coming year. The firm is operating at full capacity. Data for use in the forecast are shown below. However, the CEO is concerned about the impact of a change in the payout ratio from the 10% that was used in the past to 50%, which the firm's investment bankers have recommended. Based on the AFN equation, by how much would the AFN for the coming year change if HHW increased the payout from 10% to the new and higher level? All dollars are in millions.

A) $31.9

B) $33.6

C) $35.3

D) $37.0

E) $38.9

Correct Answer:

Verified

Q4: One of the necessary steps in the

Q5: A firm will use spontaneous funds to

Q6: A firm's AFN must come from external

Q23: Which of the following statements is CORRECT?

A)

Q24: A company expects sales to increase during

Q24: Daniel Sawyer, the CEO of the Sawyer

Q25: If a firm's capital intensity ratio (A0*/S0)

Q26: A firm's profit margin is 5%, its

Q33: Spontaneous funds are generally defined as follows:

A)

Q36: The capital intensity ratio is generally defined

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents