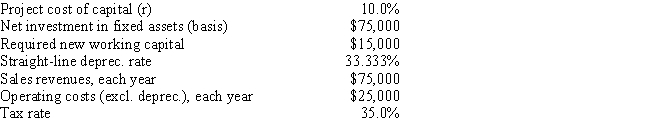

Garden-Grow Products is considering a new investment whose data are shown below. The equipment would be depreciated on a straight-line basis over the project's 3-year life, would have a zero salvage value, and would require some additional working capital that would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's life. What is the project's NPV? (Hint: Cash flows are constant in Years 1 to 3.)

A) $23,852

B) $25,045

C) $26,297

D) $27,612

E) $28,993

Correct Answer:

Verified

Q47: Kasper Film Co.is selling off some old

Q48: VR Corporation has the opportunity to invest

Q50: McPherson Company must purchase a new milling

Q51: Whitestone Products is considering a new project

Q53: Sheridan Films is considering some new equipment

Q54: DeVault Services recently hired you as a

Q55: Weston Clothing Company is considering manufacturing a

Q56: To increase productive capacity, a company is

Q56: In your first job with TBL Inc.

Q57: Century Roofing is thinking of opening a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents