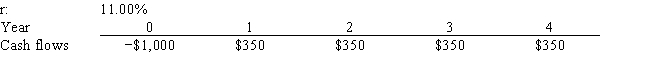

Scott Enterprises is considering a project that has the following cash flow and cost of capital (r) data. What is the project's NPV? Note that if a project's expected NPV is negative, it should be rejected.

A) $77.49

B) $81.56

C) $85.86

D) $90.15

E) $94.66

Correct Answer:

Verified

Q2: A firm should never accept a project

Q3: A basic rule in capital budgeting is

Q8: Conflicts between two mutually exclusive projects occasionally

Q9: Assuming that their NPVs based on the

Q12: Robbins Inc. is considering a project that

Q14: Conflicts between two mutually exclusive projects occasionally

Q15: Dickson Co. is considering a project that

Q18: Other things held constant, an increase in

Q20: Patterson Co. is considering a project that

Q35: The NPV method's assumption that cash inflows

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents