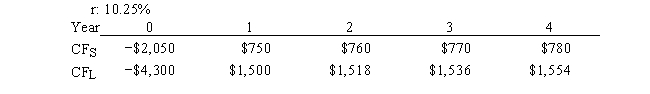

Projects S and L, whose cash flows are shown below, are mutually exclusive, equally risky, and not repeatable. Hooper Inc. is considering which of these two projects to undertake. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, so no value will be lost if the IRR method is used.

A) $134.79

B) $141.89

C) $149.36

D) $164.29

E) $205.36

Correct Answer:

Verified

Q47: Projects A and B are mutually exclusive

Q65: Nichols Inc. is considering a project that

Q66: Modern Refurbishing Inc. is considering a project

Q67: Spence Company is considering a project that

Q68: Carolina Company is considering Projects S and

Q69: Hart Corp. is considering a project that

Q70: When evaluating mutually exclusive projects, the modified

Q71: Kiley Electronics is considering a project that

Q74: Markman & Sons is considering Projects S

Q77: The NPV and IRR methods, when used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents