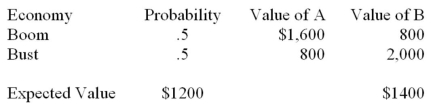

Firm A does well in a boom economy.Firm B does well in a bust economy.The probability of a boom is 50%.The end of period values of the two firms depend on the economy as shown below:  Both firms have debt outstanding with a face value of $1,000.In order to diversify,the two firms have proposed a merger.The NPV of the merger is zero.Which of the following statements is correct?

Both firms have debt outstanding with a face value of $1,000.In order to diversify,the two firms have proposed a merger.The NPV of the merger is zero.Which of the following statements is correct?

A) The stockholders are indifferent to merger since the NPV is zero.

B) The bondholders are indifferent to merger since the NPV is zero.

C) The bondholders stand to gain because the risk of the combined firm is less.

D) The stockholders stand to gain because the probability of bankruptcy becomes zero after the merger.

Correct Answer:

Verified

Q5: Following an acquisition, the acquiring firm's statement

Q12: If the acquiring firm and acquired firm

Q21: What is the cost of acquiring A

Q21: A merger that improves the use of

Q29: If two leveraged firms merge, the cost

Q30: The market for corporate control is a

Q35: Which of the following is not true

Q37: When two firms merge and there is

Q39: A merger should not take place simply

Q49: Firm A is acquiring Firm B for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents