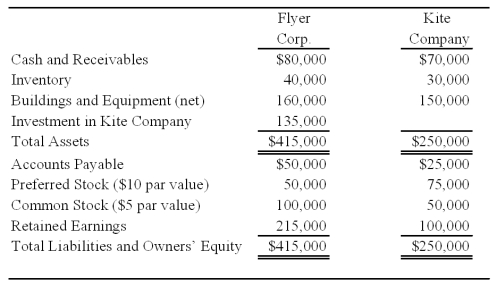

Flyer Corporation holds 90 percent of Kite Company's common shares but none of its preferred shares.On the date of acquisition,the fair value of the noncontrolling interest was equal to 10 percent of the book value of Kite Company.Summary balance sheets for the companies on December 31,2008,are as follows:

Flyer's preferred pays a 8 percent annual dividend,and Kite's preferred pays a 10 percent dividend.Kite's preferred shares can be converted into 20,000 shares of common stock at any time.Kite reported net income of $35,000 and paid a total of $10,000 of dividends in 2008.Flyer reported income from its separate operations of $80,000 and paid total dividends of $25,000 in 2008.

-Based on the information provided,what is the diluted earnings per share for the consolidated entity for 2008?

A) 4.53

B) 4.33

C) 4.00

D) 3.80

Correct Answer:

Verified

Q19: Assume that New Life uses the direct

Q32: Using the data presented in question 38:

1)Prepare

Q33: Catalyst Corporation acquired 90 percent of Trigger

Q34: Company A holds 70 percent of the

Q36: Company A owns 85 percent of Company

Q38: Company A owns 85 percent of Company

Q40: Catalyst Corporation acquired 90 percent of Trigger

Q41: Power Corporation owns 75 percent of Transmitter

Q42: For the first quarter of 2008,Vinyl Corporation

Q46: Company A owns 85 percent of Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents