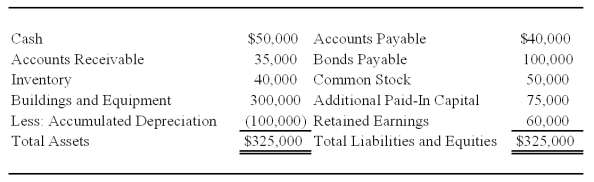

Cinema Company acquired 70 percent of Movie Corporation's shares on December 31,2005,at underlying book value of $98,000.At that date,the fair value of the noncontrolling interest was equal to 30 percent of the book value of Movie Corporation.Movie's balance sheet on January 1,2008,contained the following balances:

On January 1,2008,Movie acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

-Based on the preceding information,the eliminating entry needed in preparing a consolidated balance sheet immediately following the acquisition of shares will include:

A) a credit to Noncontrolling Interest for $19,375.

B) a credit to Additional Paid-In Capital for $75,000.

C) a debit to Treasury Shares for $30,000.

D) a credit to Investment in Movie stock for $6,125.

Correct Answer:

Verified

Q18: Winner Corporation acquired 80 percent of the

Q19: On January 1,2009,A Company acquired 85 percent

Q20: X Corporation owns 80 percent of Y

Q21: Vision Corporation acquired 75 percent of the

Q22: Micron Corporation owns 75 percent of the

Q24: Cinema Company acquired 70 percent of Movie

Q25: Vision Corporation acquired 75 percent of the

Q27: Perfect Corporation acquired 70 percent of Trevor

Q33: Vision Corporation acquired 75 percent of the

Q36: Perfect Corporation acquired 70 percent of Trevor

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents