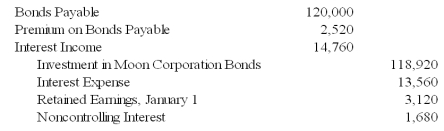

Moon Corporation issued $300,000 par value 10-year bonds at 107 on January 1,2003,which Star Corporation purchased.On July 1,2007,Sun Corporation purchased $120,000 of Moon bonds from Star.The bonds pay 12 percent interest annually on December 31.The preparation of consolidated financial statements for Moon and Sun at December 31,2009,required the following eliminating entry:

-Based on the information given above,what amount of gain or loss on bond retirement is included in the 2007 consolidated income statement?

A) $6,600

B) $4,800

C) $6,000

D) $5,400

Correct Answer:

Verified

Q3: Light Corporation owns 80 percent of Sound

Q4: Hunter Corporation holds 80 percent of the

Q6: At the end of the year,a parent

Q7: Moon Corporation issued $300,000 par value 10-year

Q9: Saturn Corporation issued $300,000 par value 10-year

Q10: Light Corporation owns 80 percent of Sound

Q11: ABC,a holder of a $400,000 XYZ Inc.bond,collected

Q12: Light Corporation owns 80 percent of Sound

Q13: Hunter Corporation holds 80 percent of the

Q29: Hunter Corporation holds 80 percent of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents