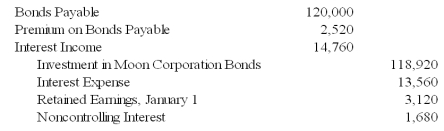

Moon Corporation issued $300,000 par value 10-year bonds at 107 on January 1,2003,which Star Corporation purchased.On July 1,2007,Sun Corporation purchased $120,000 of Moon bonds from Star.The bonds pay 12 percent interest annually on December 31.The preparation of consolidated financial statements for Moon and Sun at December 31,2009,required the following eliminating entry:

-Based on the information given above,if 2009 consolidated net income of $50,000 would have been reported without the eliminating entry provided,what amount will actually be reported?

A) $47,900

B) $48,200

C) $49,400

D) $48,800

Correct Answer:

Verified

Q3: Light Corporation owns 80 percent of Sound

Q4: Hunter Corporation holds 80 percent of the

Q6: At the end of the year,a parent

Q8: Moon Corporation issued $300,000 par value 10-year

Q9: Saturn Corporation issued $300,000 par value 10-year

Q10: Light Corporation owns 80 percent of Sound

Q11: ABC,a holder of a $400,000 XYZ Inc.bond,collected

Q12: Light Corporation owns 80 percent of Sound

Q16: When one company purchases the debt of

Q29: Hunter Corporation holds 80 percent of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents