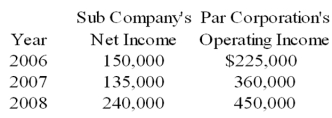

Sub Company sells all its output at 20 percent above cost to Par Corporation.Par purchases its entire inventory from Sub.The incomes reported by the companies over the past three years are as follows:

Sub Company sold inventory for $300,000,$262,500 and $337,500 in the years 20X6,20X7,and 20X8 respectively.Par Company reported ending inventory of $105,000,$157,500 and $180,000 for 20X6,20X7,and 20X8 respectively.Par acquired 70 percent of the ownership of Sub on January 1,20X6,at underlying book value.The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

-A subsidiary made sales of inventory to its parent at a profit this year.The parent,in turn,sold all but 20 percent of the inventory to unaffiliated companies,recognizing a profit.The amount that should be reported as cost of goods sold in the consolidated income statement prepared for the year should be:

A) the amount reported as intercompany sales by the subsidiary.

B) the amount reported as intercompany sales by the subsidiary minus unrealized profit in the ending inventory of the parent.

C) the amount reported as cost of goods sold by the parent minus unrealized profit in the ending inventory of the parent.

D) the amount reported as cost of goods sold by the parent.

Correct Answer:

Verified

Q27: Push Company owns 60% of Shove Company's

Q30: Pilfer Company acquired 90 percent ownership of

Q32: Push Company owns 60% of Shove Company's

Q34: Push Company owns 60% of Shove Company's

Q35: Pilfer Company acquired 90 percent ownership of

Q41: Sub Company sells all its output at

Q42: Sub Company sells all its output at

Q51: The consolidation treatment of profits on inventory

Q53: Parent Corporation owns 90 percent of Subsidiary

Q57: Sub Company sells all its output at

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents