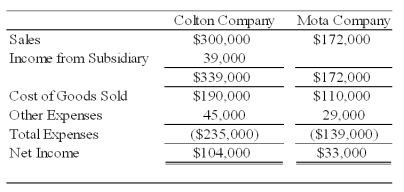

Colton Company acquired 80 percent ownership of Mota Company's voting shares on January 1,2008,at underlying book value.The fair value of the noncontrolling interest on that date was equal to 20 percent of the book value of Mota Company.During 2008,Colton purchased inventory for $30,000 and sold the full amount to Mota Company for $50,000.On December 31,2008,Mota's ending inventory included $10,000 of items purchased from Colton.Also in 2008,Mota purchased inventory for $80,000 and sold the units to Colton for $100,000.Colton included $30,000 of its purchase from Mota in ending inventory on December 31,2008.Summary income statement data for the two companies revealed the following:

Required:

a.Compute the amount to be reported as sales in the 2008 consolidated income statement.

b.Compute the amount to be reported as cost of goods sold in the 2008 consolidated income statement.

c.What amount of income will be assigned to the noncontrolling shareholders in the 2008 consolidated income statement?

d.What amount of income will be assigned to the controlling interest in the 2008 consolidated income statement?

Correct Answer:

Verified

Information on...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: During the year a parent makes sales

Q15: Consolidated net income may include the parent's

Q31: Sub Company sells all its output at

Q31: Elvis Company purchases inventory for $70,000 on

Q33: Sub Company sells all its output at

Q34: Perth Corporation owns 90 percent of Dundee

Q37: ABC Corporation owns 75 percent of XYZ

Q38: ABC Corporation owns 75 percent of XYZ

Q40: Sub Company sells all its output at

Q41: On January 1,2007,Jones Company acquired 90 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents