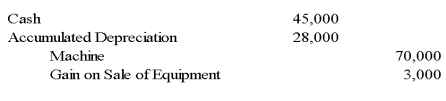

On January 1,2007,Servant Company purchased a machine with an expected economic life of five years.On January 1,2009,Servant sold the machine to Master Corporation and recorded the following entry:

Master Corporation holds 75 percent of Servant's voting shares.Servant reported net income of $50,000,and Master reported income from its own operations of $100,000 for 2009.There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

-Based on the preceding information,in the preparation of the 2009 consolidated income statement,depreciation expense will be:

A) Debited for $1,000 in the eliminating entries.

B) Credited for $1,000 in the eliminating entries.

C) Debited for $15,000 in the eliminating entries.

D) Credited for $15,000 in the eliminating entries.

Correct Answer:

Verified

Q1: Which of the following are examples of

Q3: Any intercompany gain or loss on a

Q16: Mortar Corporation acquired 80 percent of Granite

Q17: Sky Corporation owns 75 percent of Earth

Q18: Sky Corporation owns 75 percent of Earth

Q19: Phobos Company holds 80 percent of Deimos

Q20: Mortar Corporation acquired 80 percent of Granite

Q22: Blue Corporation holds 70 percent of Black

Q23: Big Corporation receives management consulting services from

Q25: Parent Corporation purchased land from S1 Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents