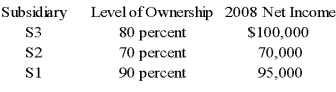

Parent Corporation purchased land from S1 Corporation for $220,000 on December 26,2008.This purchase followed a series of transactions between P-controlled subsidiaries.On February 15,2008,S3 Corporation purchased the land from a nonaffiliate for $160,000.It sold the land to S2 Company for $145,000 on October 19,2008,and S2 sold the land to S1 for $197,000 on November 27,2008.Parent has control of the following companies:

Parent reported income from its separate operations of $200,000 for 2008.

-Based on the preceding information,what should be the amount of income assigned to the controlling shareholders in the consolidated income statement for 2008?

A) $369,400

B) $405,000

C) $465,000

D) $60,000

Correct Answer:

Verified

Q26: A parent sold land to its partially

Q29: On January 1,2007,Servant Company purchased a machine

Q30: Blue Corporation holds 70 percent of Black

Q31: On January 1,2007,Servant Company purchased a machine

Q32: Mortar Corporation acquired 80 percent of Granite

Q33: Blue Corporation holds 70 percent of Black

Q35: Big Corporation receives management consulting services from

Q36: Blue Corporation holds 70 percent of Black

Q37: Mortar Corporation acquired 80 percent of Granite

Q38: On January 1,2007,Servant Company purchased a machine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents