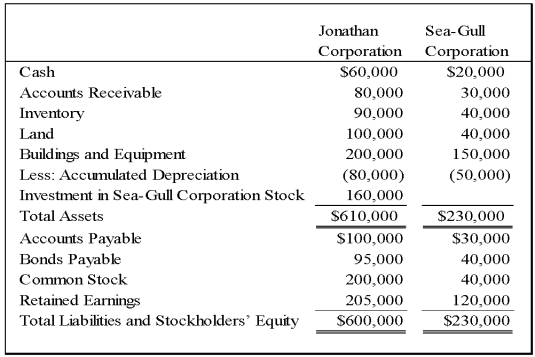

On January 1,2009,Gulliver Corporation acquired 80 percent of Sea-Gull Company's common stock for $160,000 cash.The fair value of the noncontrolling interest at that date was determined to be $40,000.Data from the balance sheets of the two companies included the following amounts as of the date of acquisition:

At the date of the business combination,the book values of Sea-Gull's net assets and liabilities approximated fair value except for inventory,which had a fair value of $45,000,and land,which had a fair value of $60,000.

-Based on the preceding information,what amount of total liabilities will be reported in the consolidated balance sheet prepared immediately after the business combination?

A) $395,000

B) $280,000

C) $265,000

D) $195,000

Correct Answer:

Verified

Q2: On January 1,20X9,Gulliver Corporation acquired 80 percent

Q4: On January 1,2008,Wilhelm Corporation acquired 90 percent

Q5: On January 1,2008,Climber Corporation acquired 90 percent

Q9: Based on the preceding information,what amount of

Q10: On January 1,2008,Wilhelm Corporation acquired 90 percent

Q11: Based on the preceding information,what amount will

Q14: On January 1,2008,Climber Corporation acquired 90 percent

Q16: On January 1,20X9,Pirate Corporation acquired 80 percent

Q18: Postage Corporation acquired 75 percent of Stamp

Q27: The following information applies to Questions 29-31

On

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents