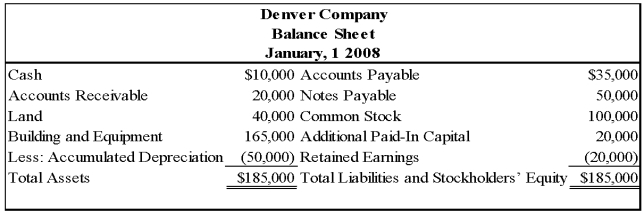

On January 1,2008,Colorado Corporation acquired 75 percent of Denver Company's voting common stock for $90,000 cash.At that date,the fair value of the noncontrolling interest was $30,000.Denvers's balance sheet at the date of acquisition contained the following balances:

At the date of acquisition,the reported book values of Denver's assets and liabilities approximated fair value.Eliminating entries are being made to prepare a consolidated balance sheet immediately following the business combination.

-Based on the preceding information,in the entry to eliminate the investment balance,

A) retained earnings will be credited for $20,000.

B) additional paid-in-capital will be credited for $20,000.

C) differential will be credited for $10,000.

D) noncontrolling interest will be debited for 30,000.

Correct Answer:

Verified

Q5: On January 1,20X9,Pirate Corporation acquired 80 percent

Q7: Based on the preceding information,what amount of

Q20: On January 1,2008,Ramon Corporation acquired 75 percent

Q21: On January 1,2008,Bristol Company acquired 80 percent

Q24: On December 31,2008,X Company acquired controlling ownership

Q25: On January 1,2004,Plimsol Company acquired 100 percent

Q26: On December 31,2008,Melkor Corporation acquired 80 percent

Q27: On January 1,2004,Plimsol Company acquired 100 percent

Q28: On December 31,2008,X Company acquired controlling ownership

Q45: On January 1,20X8,Parsley Corporation acquired 75 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents