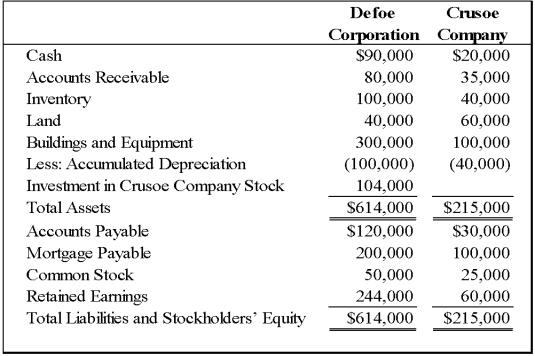

On December 31,2008,Defoe Corporation acquired 80 percent of Crusoe Company's common stock for $104,000 cash.The fair value of the noncontrolling interest at that date was determined to be $26,000.Data from the balance sheets of the two companies included the following amounts as of the date of acquisition:

On that date,the book values of Crusoe's assets and liabilities approximated fair value except for inventory,which had a fair value of $45,000,and buildings and equipment,which had a fair value of $100,000.At December 31,2008,Defoe reported accounts payable of $15,000 to Crusoe,which reported an equal amount in its accounts receivable.

Required:

1)Provide the eliminating entries needed to prepare a consolidated balance sheet immediately following the business combination.

2)Prepare a consolidated balance sheet workpaper.

3)Prepare a consolidated balance sheet in good form.

Correct Answer:

Verified

Q21: The following information applies to Questions 21-26

On

Q33: On December 31,20X8,Peak Corporation acquired 80 percent

Q38: On December 31,2008,Melkor Corporation acquired 80 percent

Q39: On January 1,2004,Plimsol Company acquired 100 percent

Q40: On January 1,2004,Plimsol Company acquired 100 percent

Q41: On January 1,2008,Gregory Corporation acquired 90 percent

Q43: Magellan Corporation acquired 80 percent ownership of

Q44: On January 1,2008,Vector Company acquired 80 percent

Q45: On January 1,2008,Gregory Corporation acquired 90 percent

Q47: On January 1,2008,Zeta Company acquired 85 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents