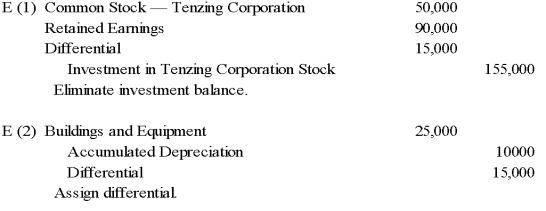

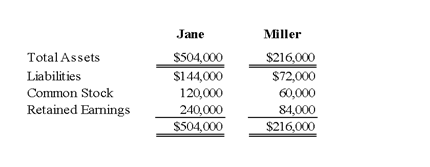

On January 3, 2009, Jane Company acquired 75 percent of Miller Company's outstanding common stock for cash. The fair value of the noncontrolling interest was equal to a proportionate share of the book value of Miller Company's net assets at the date of acquisition. Selected balance sheet data at December 31, 2009, are as follows:

-Based on the preceding information,what amount should be reported as noncontrolling interest in net assets in Jane Company's December 31,2009,consolidated balance sheet?

A) $90,000

B) $54,000

C) $36,000

D) $0

Correct Answer:

Verified

Q6: Under FASB 141R,consolidation follows largely which theory

Q10: On January 3,2009,Redding Company acquired 80 percent

Q11: On January 3,2009,Redding Company acquired 80 percent

Q16: On January 3,2009,Redding Company acquired 80 percent

Q18: Princeton Company acquired 75 percent of the

Q18: If Push Company owned 51 percent of

Q22: Prime Company acquired 100 percent of the

Q23: Prime Company acquired 100 percent of the

Q24: Beta Company acquired 100 percent of the

Q32: Small-Town Retail owns 70 percent of Supplier

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents