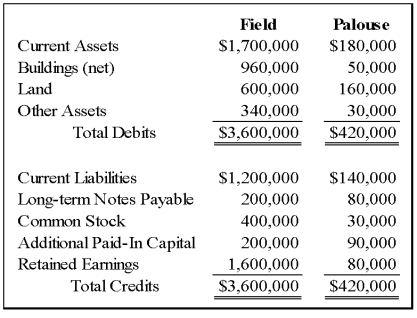

On January 1,2009,Field Corporation,a retail outlet chain,acquired 100 percent of the common stock of Palouse Company by issuing 14,000 shares of Field's $5 par value common stock.The market price of Field's common stock was $20 per share on the eve of December 31,2008.Summarized balance sheet data at December 31,2008,are as follows:

Additional Information:

The book values of Palouse's assets approximated their respective fair values,except for inventory (included in current assets),which had a fair value $20,000 more than book value,and land,which had a market value of $200,000 on the date of combination.At that date,Field owed Palouse $34,000 on account.

Required: Prepare a consolidated balance sheet immediately following the acquisition.

Correct Answer:

Verified

Q6: In which of the following cases would

Q15: Consolidated financial statements tend to be most

Q34: FASB issued Interpretation No.46 R related to

Q35: On January 1,2009,Gold Rush Company acquires 80

Q38: Quid Corporation acquired 60 percent of Pro

Q39: Dish Corporation acquired 100 percent of the

Q40: Zeta Corporation and its subsidiary reported consolidated

Q42: Barnes Company acquired 80 percent of the

Q43: The Hamilton Company acquired 100 percent of

Q47: On January 1, 20X9, Heathcliff Corporation acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents