Haskell,Inc.,reported the following income before income taxes,income taxes expense,and net income for 2009 and 2010:

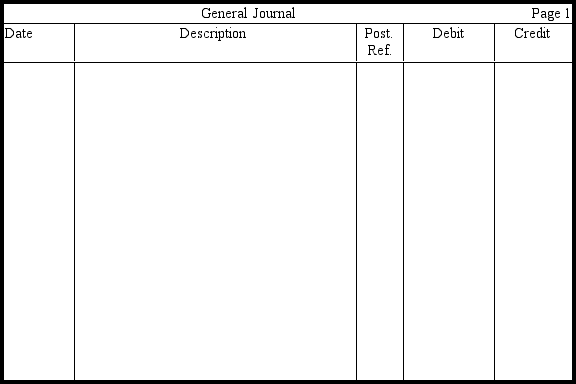

In 2009,Haskell deducted a $35,000 item for income tax purposes that was not deducted for accounting purposes until 2010.Haskell's marginal tax rate is 40 percent.Prepare entries in journal form without explanations to record Haskell's income taxes expense and income taxes payable for each year,assuming that income tax allocation procedures are used properly.

Correct Answer:

Verified

Q141: How do the accounting conventions of full

Q142: Why must certain income statement items be

Q143: Specifically, what gives rise to the Deferred

Q145: Why would a financial analyst consider the

Q147: Elmwood Corporation reported earnings per share of

Q153: Distinguish between cash and retained earnings.

Q155: Ricardo Corporation reported earnings per share of

Q159: What issues must be considered when determining

Q160: What are potentially dilutive securities, and how

Q161: The following facts pertain to the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents