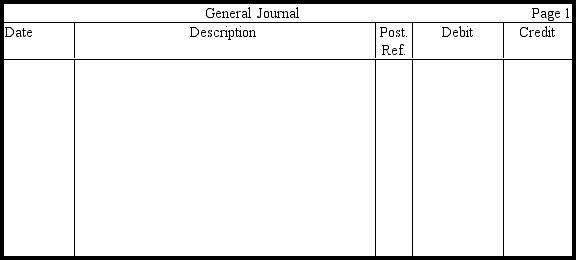

Kagel Corporation computed its actual income taxes payable for 20xx to be $92,000.Because of differences in accounting procedures and income tax rules,the income taxes expense to be reported for 20xx is $107,000.Prepare the entry in journal form without explanation to record the income taxes expense and income taxes payable for 20xx.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: A corporation should account for the declaration

Q144: Ballard Corporation has retained earnings of $200,000.

Q145: Elias Corporation has 40,000 shares of

Q146: Nagle Corporation computed its actual income taxes

Q147: Indicate on the blanks below the effect

Q148: Ballard Corporation has retained earnings of $200,000.

Q152: What is the basis of the statement

Q154: How is it possible for a company

Q156: Define the term quality of earnings, and

Q157: Which of the following has an effect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents