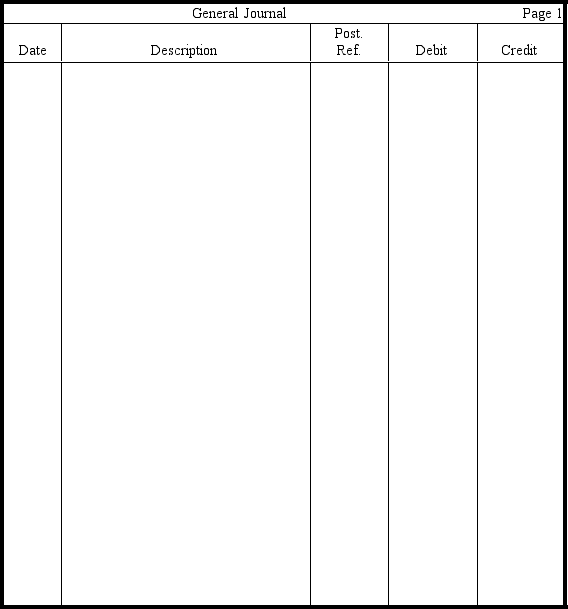

Using the journal provided,enter the following transactions for LaPana Corporation for 2009 and 2010.Please provide all explanations.

Aug. 13 Purchased 1,000 shares of Casper Corporation stock for . These securities were purchased primarily for trading purposes.

Oct. 5 Purchased 4,000 shares of Tally Corporation stock for . These securities were purchased primarily for trading purposes.

Nov. 1 Invested in 120 -day U.S. Treasury bills that have a maturity value of .

Dec. 31 The market value of the Casper Corporation shares is , and the market value of the Tally Corporation stock is . A year-end adjustment is made.

31 A year-end adjustment is made for accrued interest on the Treasury bills.

2010

Mar. 1 Received maturity value of U.S. Treasury bills in cash.

Apr. 14 Sold all 1,000 shares of Casper Corporation stock for .

Sept. 22 Received dividends of per share from Tally Corporation.

Dec. 31 The market value of the Tally Corporation shares is . A year-end adjustment is made.

Correct Answer:

Verified

Q132: Coll Company (the parent company)manufactured a product

Q139: Wyfker Company and Mularkey Company have separate

Q142: On January 1,Chapin Corporation purchased,as long-term investments,10

Q145: Barker Company purchased 100 percent of Coll

Q146: Briefly explain,what are the consolidated financial statements,and

Q146: At the beginning of the current year,Morris

Q147: In the journal provided,prepare the entries

Q148: The following transactions and information pertain

Q150: On January 1,2010,Remco Corporation purchased 5,000 shares

Q156: When are eliminating entries made,where are they

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents