The following transactions and information pertain to Yates Corporation for 2009 and 2010.

2009

May 1 Purchased 3,000 shares of Ross Corporation common stock at per share (representing 5 percent of Ross's total outstanding stock) as a long-term investment.

Sept. 1 Received a cash dividend from Ross equal to per share.

Dec. 31 Market value of Ross stock at year end was per share.

2010

Sept. 1 Received a cash dividend from Ross equal to $1.40 per share.

Nov. 1 Sold 400 shares of Ross at per share.

Dec. 31 Market value of Ross stock at vear end was per share.

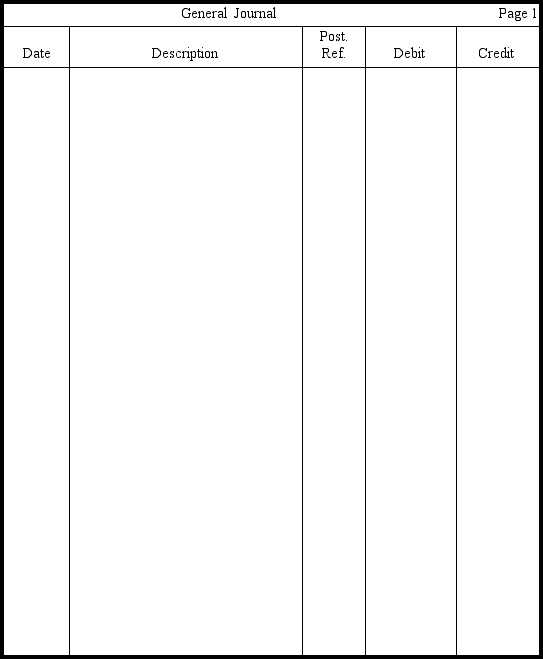

Prepare entries in journal form,without explanations,to record the above.Yates's accounting year ends December 31.

Correct Answer:

Verified

Q93: When a company receives a dividend from

Q150: On January 1,2009,Grant Corporation acquired 90 percent

Q151: On January 1,20xx,Hilary Corporation acquired 100 percent

Q154: McDuff Company owns 100 percent of

Q155: Knabe Corporation purchased 3,000 shares of Duncan

Q156: Ming Company purchased 100 percent of Savran

Q157: The stockholders' equity section of Ernesto

Q159: In the journal provided,prepare the entries

Q160: On November 19,2009,Lassen Company purchased 30,000 shares

Q168: Nate Lobell is the president and sole

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents