On its December 31,2009,balance sheet,Montrose Corporation reported its stockholders' equity as follows:

During 2010,the following transactions occurred:

Reacquired 2,500 shares at $7 per share.

Sold 1,200 shares of treasury stock at $8 per share.

Sold 500 shares of treasury stock at $6 per share.

Net income for 2010 amounted to $80,000.

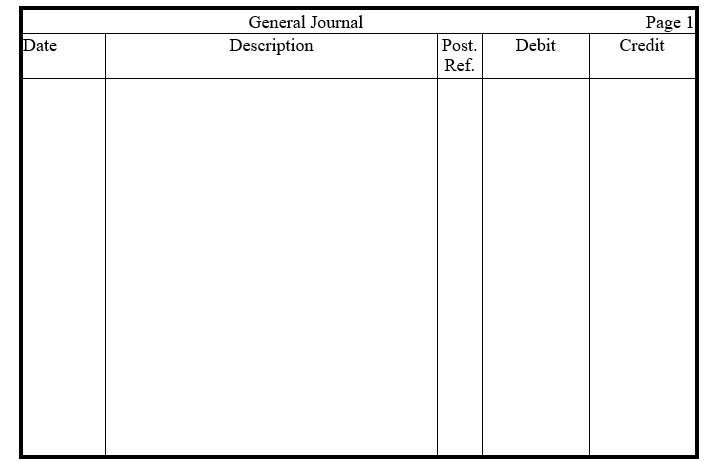

a. Prepare the entries in journal form for the three transactions involving treasury stock. (Omit explanations.)

b. Compute the amount of total contributed capital to be reported on the December 31, 2010, balance sheet.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q127: The purchase of treasury stock will result

Q143: Indicate on the blanks below the net

Q157: Use the following information to answer

Q158: Identify (by code letter)each of the following

Q161: Prepare the entries in journal form

Q163: Stonehurst Corporation is authorized to issue

Q165: In its 2010 annual report,Gamma Company indicated

Q167: Prepare in proper form the stockholders'

Q168: Paloma Corporation had 5,000 shares of $100

Q174: Define outstanding stock.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents