On March 1,2009,Sklar Corporation issued bonds with a face value of $400,000.The bonds carry a face interest rate of 12 percent that is payable each June 30 and December 31.The bonds were sold at 100.The corporation's accounting year ends on December 31.

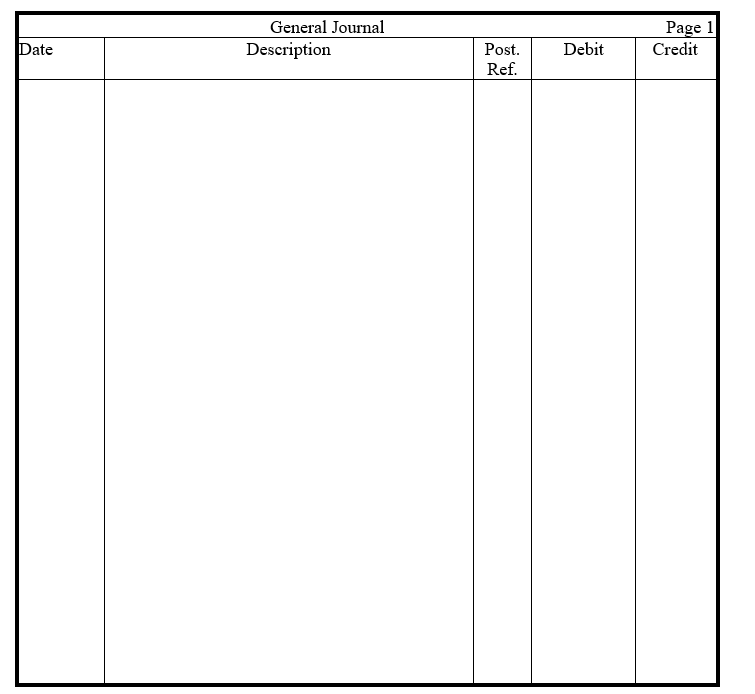

a. Prepare an entry in journal form without explanation to record the issuance of the bonds on March 1, 2009.

b. Prepare an entry in journal form without explanation to record the interest payment on June 30, 2009.

c. Prepare an entry in journal form without explanation to record the interest payment on December 31, 2009.

d. Calculate the amount that should appear for Bond Interest Expense on Sklar's income statement for the year ended December 31, 2009. Show your calculations.

e. Calculate the amount that should appear for Bond Interest Expense on Sklar's income statement for the year ended December 31, 2010. Show your calculations.

Correct Answer:

Verified

Q172: West Valley Corporation issues $800,000 of 20-year,9

Q188: When bonds are converted to common stock,what

Q191: On December 31, 2009, the balance sheet

Q193: On July 1,20xx,Benchley Corporation issued bonds with

Q195: On January 2,20xx,Horst Corporation issued ten-year,8 percent

Q196: According to the long-term debt note in

Q197: McPherson Corporation has $1,000,000 of 20-year,9 percent

Q199: On November 1,2009,Fields Corporation issued $800,000 worth

Q202: On December 31,2009,the balance sheet of L

Q203: Identify each of the following characteristics as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents