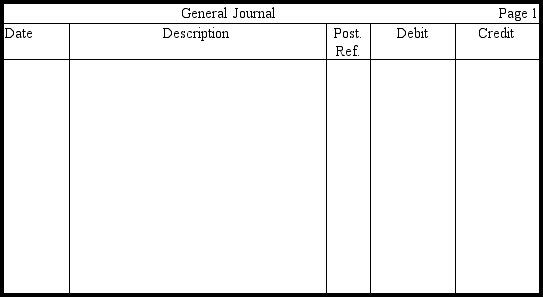

Darla Katz earns an hourly wage of $12,with time-and-a-half pay for hours worked over 40 per week.During the most recent week,she worked 46 hours,her federal tax withholding totaled $62,her state tax withholding totaled $18,and $3 was withheld for union dues.Assuming a 6.2 percent social security tax rate and a 1.45 percent Medicare tax rate,prepare the entry without explanation in the journal provided to record Katz's wages and related liabilities.Round to the nearest penny.

Correct Answer:

Verified

Q163: Calculate answers to the following questions using

Q164: You win the grand prize and can

Q164: The owner of an amusement park is

Q170: State whether each situation below implies a

Q176: Kahn Company had cash sales of $60,000

Q178: Calculate answers to the following questions using

Q179: Calculate answers to the following questions using

Q179: Jim Janney is paid $6 per hour,

Q181: Lee Provo is paid $8 per hour,plus

Q191: Calculate answers to the following questions using

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents