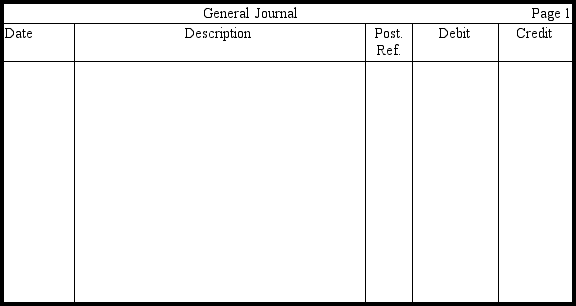

In the journal provided,prepare the entries for the following transactions.(Omit explanations.)

Dec. 1 Sold merchandise on account to Katurah Wells for .

12 Received payment of from Katurah Wells.

31 Made adjusting entry for Uncollectible Accounts Expense, using the percentage of net sales method. Net sales for the year totaled , uncollectible accounts are estimated at 2 percent, and Allowance for Uncollectible Accounts has a credit balance prior to adjustment.

Feb. 5 Wrote off Katurah Wells's balance because she filed for bankruptcy.

17 Unexpectedly received the from Katurah Wells.

Correct Answer:

Verified

Q145: At year end,Erwin Graphics has a $350

Q154: On December 31,Skinner Enterprises has a $400

Q161: Under what specific circumstance will application of

Q162: Caplan Corporation uses the accounts receivable aging

Q163: Assuming that the allowance method is

Q165: In the journal provided,prepare entries for

Q169: Assume that part of accounts and other

Q170: Assume that part of accounts and other

Q171: The general ledger account for Accounts Receivable

Q172: At year end, Gorgin Design Company has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents