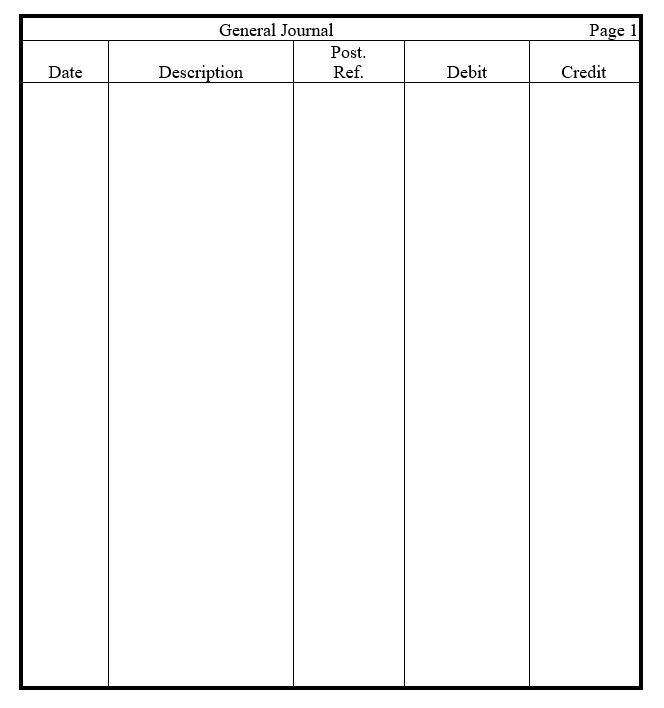

Prepare year-end adjusting entries for each of the following situations:

a. The Store Supplies account showed a beginning debit balance of $400 and purchases of $2,800. The ending debit balance was $800.

b. Depreciation on buildings is estimated to be $7,300.

c. A one-year insurance policy was purchased for $2,400. Nine months have passed since the purchase.

d. Accrued interest on notes payable amounted to $200.

e. The company received a $9,600 advance payment during the year on services to be performed. By the end of the year, one-third of the services had been performed.

f. Payroll for the five-day workweek, to be paid on Friday, is $10,000. The last day of the period is a Tuesday.

g. Services totaling $920 had been performed but not yet billed or recorded.

Correct Answer:

Verified

Q162: Answer the following questions.(Show your work. )

a.Revenue

Q203: What broad purposes are accomplished by closing

Q222: Susan Kane won the mayoral election in

Q224: Below are the adjusted accounts of

Q225: The Retained Earnings,Dividends,and Income Summary accounts for

Q226: The following amounts are taken from

Q227: The 20xx income statement for Newton

Q231: Presented below are the Retained Earnings,Dividends,and Income

Q234: Given the adjusted trial balance below,prepare

Q238: Answer the following questions.(Show your work.)

a. A

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents