An investor wants to invest $50,000 in two mutual funds,A and B.The rates of return,risks and minimum investment requirements for each fund are:

Note that a low Risk rating means a less risky investment.The investor can invest to maximize the expected rate of return or minimize risk.Any money beyond the minimum investment requirements can be invested in either fund.

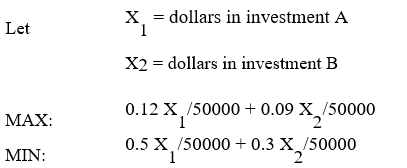

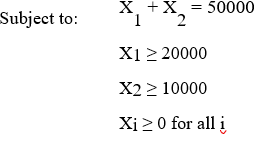

The following is the MOLP formulation for this problem:

The solution for the second LP is X1,X2)= 20,000,30,000).

What formulas should go in cells B2:D11 of the spreadsheet? NOTE: Formulas are not required in all of these cells.

Correct Answer:

Verified

D6 =...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Goal programming (GP) is:

A) iterative

B) inaccurate

C) static

D)

Q41: A hard constraint

A) cannot be violated

B) may

Q46: Goal programming (GP) is typically

A) a minimization

Q51: Deviational variables

A)are added to constraints to indicate

Q52: An investor wants to invest $50,000

Q53: An investor wants to invest $50,000

Q54: Exhibit 7.4

The following questions are based

Q59: A dietician wants to formulate a

Q60: In the "triple bottom line" the term

Q79: Exhibit 7.4

The following questions are based on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents