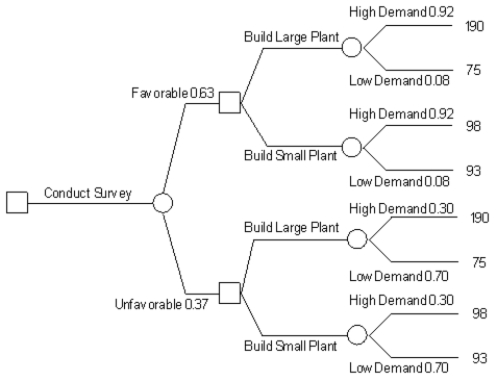

A company is planning a plant expansion.They can build a large or small plant.The payoffs for the plant depend on the level of consumer demand for the company's products.The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low.The company can pay a market research firm to survey consumer attitudes towards the company's products.There is a 63% chance that the customers will like the products and a 37% chance that they won't.The payoff matrix and costs of the two plants are listed below.The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products.If the survey is unfavorable there is only a 30% chance that the demand will be high.The following decision tree has been built for this problem.The company has computed that the expected monetary value of the best decision without sample information is 154.35 million.What is the EVSI for this problem in $ million) ?

A) 0.07

B) 26.38

C) 109.5

D) 180.8

Correct Answer:

Verified

Q16: The scores in a scoring model range

Q22: Exhibit 14.5

The following questions are based on

Q43: Exhibit 14.7

The following questions use the information

Q51: Based on the radar chart of raw

Q52: A fast food restaurant is considering opening

Q53: Based on the radar chart of the

Q54: An investor is considering 2 investments,A,B,which can

Q67: Exhibit 14.6

The following questions use the information

Q71: Exhibit 14.6

The following questions use the information

Q88: Exhibit 14.7

The following questions use the information

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents