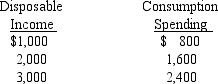

Use the table below to determine the impact on consumption spending of a $100 increase in net taxes.

A) Consumption will decrease by $80.

B) Consumption will increase by $80.

C) The marginal propensity to consume will increase to .91.

D) The marginal propensity to consume will decrease to .73.

E) The change in net taxes will not change consumption.

Correct Answer:

Verified

Q41: If real disposable income increased by $10,000

Q43: If expectations of future income become more

Q47: The marginal propensity to consume is always

A)

Q48: If the marginal propensity to consume is

Q49: If net taxes decrease,which of the following

Q52: At each level of income,net taxes reduce

Q58: Which of the following is not another

Q62: In the short-run macro model,what is the

Q74: Aggregate expenditure includes final spending by households,businesses,and

Q76: If income increased by $20,000,investment spending is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents