REFERENCE: Ref.09_09

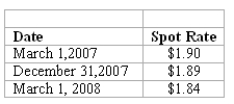

On March 1,2007,Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds.The machine was shipped and payment was received on March 1,2008.On March 1,2007,Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1,2008 at a price of $380,000.Mattie properly designates the option as a fair hedge of the pound firm commitment.The option cost $2,000 and had a fair value of $2,200 on December 31,2007.The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12 percent,and the present value factor for two months at a 12 percent annual rate is .9803.

Mattie's incremental borrowing rate is 12 percent,and the present value factor for two months at a 12 percent annual rate is .9803.

-What was the net impact on Mattie's 2007 income as a result of this fair value hedge of a firm commitment?

A) $1,660.40 decrease.

B) $1,760.60 decrease.

C) $2,240.40 decrease.

D) $1,660.40 increase.

E) $2,240.60 increase.

Correct Answer:

Verified

Q42: What was the net increase or decrease

Q44: Lawrence Company, a U.S.company, ordered parts costing

Q46: Williams, Inc., a U.S. company, has a

Q48: Larson Company, a U.S. company, has an

Q49: REFERENCE: Ref.09_07

Winston Corp. ,a U.S.company,had the following

Q51: REFERENCE: Ref.09_07

Winston Corp. ,a U.S.company,had the following

Q52: REFERENCE: Ref.09_07

Winston Corp. ,a U.S.company,had the following

Q54: REFERENCE: Ref.09_10

On October 1,2007,Eagle Company forecasts the

Q56: REFERENCE: Ref.09_08

On May 1,2007,Mosby Company received an

Q58: REFERENCE: Ref.09_07

Winston Corp. ,a U.S.company,had the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents