REFERENCE: Ref.08_10

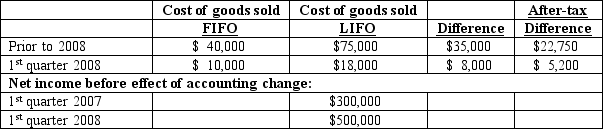

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2008.Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding.The following additional information is available:

-Assuming Baker makes the change in the first quarter of 2008,compute net income per common share.

A) $4.92.

B) $4.95.

C) $5.00.

D) $5.05.

E) $5.28.

Correct Answer:

Verified

Q62: Which of the following items of information

Q64: What is the appropriate treatment in an

Q66: How are extraordinary gains reported in a

Q73: Which of the following is reported for

Q75: How should contingencies be reported in an

Q78: REFERENCE: Ref.08_10

Baker Corporation changed from the LIFO

Q79: What is the appropriate treatment in an

Q80: Which of the following is reported for

Q81: What approach for segment determination was adopted

Q82: REFERENCE: Ref.08_10

Baker Corporation changed from the LIFO

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents