REFERENCE: Ref.08_10

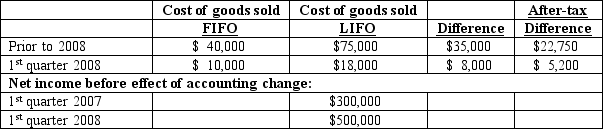

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2008.Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding.The following additional information is available:

-Assuming Baker makes the change in the first quarter of 2008,how much is reported as net income for the first quarter of 2007?

A) $300,000.

B) $322,750.

C) $335,000.

D) $265,000.

E) $277,250.

Correct Answer:

Verified

Q82: REFERENCE: Ref.08_10

Baker Corporation changed from the LIFO

Q85: What related items in regard to total

Q86: What is the major objective of segment

Q88: Burnside Corp.is organized into four operating segments.The

Q89: Why would some corporations prefer not to

Q90: What is the purpose of the FASB's

Q91: What revenues and expenses included in segment

Q96: For companies that provide quarterly reports, how

Q105: Which items of information are required to

Q115: List the five aggregation criteria that need

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents