REFERENCE: Ref.08_14 Harrison Company,Inc.began Operations on January 1,2008,and Applied the LIFO Method

REFERENCE: Ref.08_14

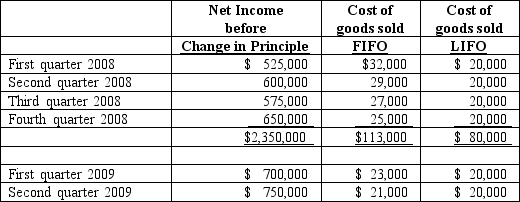

Harrison Company,Inc.began operations on January 1,2008,and applied the LIFO method for inventory valuation.On June 10,2009,Harrison adopted the FIFO method of accounting for inventory.Additional information is as follows:

The LIFO method was applied during the first quarter of 2009 and the FIFO method was applied during the second quarter of 2009 in computing income,above.Harrison's effective income tax rate is 40 percent.Harrison has 500,000 shares of common stock outstanding at all times.

The LIFO method was applied during the first quarter of 2009 and the FIFO method was applied during the second quarter of 2009 in computing income,above.Harrison's effective income tax rate is 40 percent.Harrison has 500,000 shares of common stock outstanding at all times.

-Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30,2008 and 2009.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: For each of the following situations, select

Q104: REFERENCE: Ref.08_11

Faru Co.identified five industry segments: (1)plastics,

Q105: Blanton Corporation is comprised of five operating

Q106: How much of this expense should be

Q107: Prepare the journal entries to reflect the

Q108: REFERENCE: Ref.08_11

Faru Co.identified five industry segments: (1)plastics,

Q111: REFERENCE: Ref.08_11

Faru Co.identified five industry segments: (1)plastics,

Q112: REFERENCE: Ref.08_13

Gregor,Inc. ,uses the LIFO cost-flow assumption

Q113: Prepare the journal entries to reflect the

Q113: REFERENCE: Ref.08_15

The following information for Urbanski Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents