REFERENCE: Ref.07_17 On January 1,2009,Maurice Co.acquired 75% of Lawrence Co.'s Outstanding Common

REFERENCE: Ref.07_17

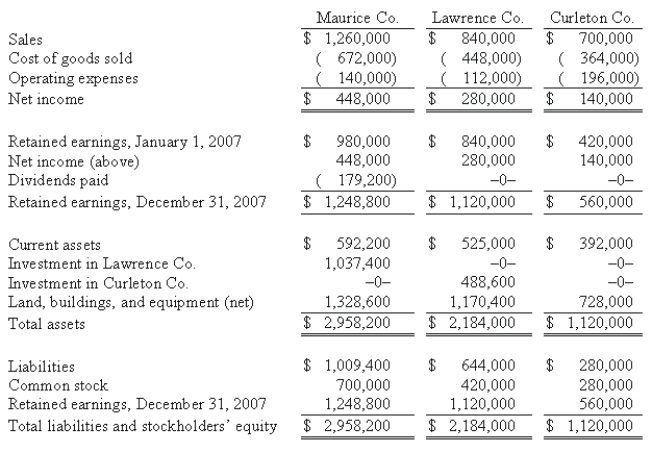

On January 1,2009,Maurice Co.acquired 75% of Lawrence Co.'s outstanding common stock.On the same date,Lawrence acquired an 80% interest in Curleton Co.Both of these investments were accounted using the initial value method.No dividends were distributed by either Lawrence or Curleton during 2009 or 2010.Maurice paid cash dividends each year equal to 40% of operating income.Reported operating income totals for 2009 were as follows:  Following are the 2010 financial statements for these three companies.Curleton made numerous transfers of inventory to Lawrence since the takeover: $112,000 (2009)and $140,000 (2010).These transactions included the same markup applicable to Curleton's outside sales.In each of these years,Lawrence carried 20% of this inventory into the succeeding year before disposing of it.

Following are the 2010 financial statements for these three companies.Curleton made numerous transfers of inventory to Lawrence since the takeover: $112,000 (2009)and $140,000 (2010).These transactions included the same markup applicable to Curleton's outside sales.In each of these years,Lawrence carried 20% of this inventory into the succeeding year before disposing of it.

An effective income tax rate of 45% was applicable to all companies.

I can't edit picture.Need to change the three years in the schedules - each from 2007 to 2010  The years should be 2010 instead of 2007 in this table

The years should be 2010 instead of 2007 in this table

-Required:

Determine the noncontrolling interest in Lawrence Co.'s net income.

Correct Answer:

Verified

Q97: Wilkins Inc. owned 60% of Motumbo Co.

Q101: Dotes, Inc. owns 40% of Abner Co.

Q106: On January 1,2009,Youder Inc.bought 120,000 shares of

Q107: REFERENCE: Ref.07_17

On January 1,2009,Maurice Co.acquired 75% of

Q108: REFERENCE: Ref.07_17

On January 1,2009,Maurice Co.acquired 75% of

Q108: For each of the following situations, select

Q108: Jull Corp. owned 80% of Solaver Co.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents