REFERENCE: Ref.06_03

These questions are based on the following information and should be viewed as independent situations.

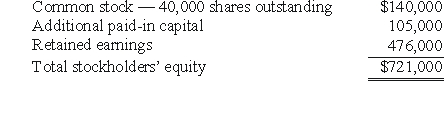

Popper Co.purchased 80% of the common stock of Cocker Co.on January 1,2004,when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker,Popper paid a total of $682,000 with any excess cost being allocated to goodwill,which has been measured for impairment annually and has not been determined to be impaired as of January 1,2009.

To acquire this interest in Cocker,Popper paid a total of $682,000 with any excess cost being allocated to goodwill,which has been measured for impairment annually and has not been determined to be impaired as of January 1,2009.

On January 1,2009,Cocker reported a net book value of $1,113,000 before the following transactions were conducted.Popper uses the equity method to account for its investment in Cocker,thereby reflecting the change in book value of Cocker.

-On January 1,2009,Cocker reacquired 8,000 of the outstanding shares of its own common stock for $34 per share.None of these shares belonged to Popper.How would this transaction have affected the additional paid-in capital of the parent company?

A) $0.

B) decrease it by $32,900.

C) decrease it by $45,700.

D) decrease it by $49,400.

E) decrease it by $50,500.

Correct Answer:

Verified

Q10: How would consolidated earnings per share be

Q17: REFERENCE: Ref.06_02

Stoop Co.owned 80% of the common

Q18: Where do intercompany sales of inventory appear

Q19: REFERENCE: Ref.06_02

Stoop Co.owned 80% of the common

Q20: REFERENCE: Ref.06_03

These questions are based on the

Q24: Which of the following statements is true

Q26: REFERENCE: Ref.06_03

These questions are based on the

Q29: On January 1, 2009, Nichols Company

Q30: Which of the following statements is true

Q37: Compute the noncontrolling interest in Smith at

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents