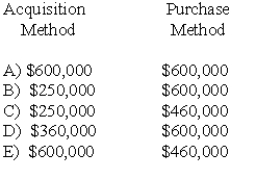

MacHeath Inc.bought 60% of the outstanding common stock of Nomes Inc.in a business combination that resulted in the recognition of goodwill.Nomes owned a piece of land that cost $250,000 but was worth $600,000 at the date of purchase.What value would be attributed to this land in a consolidated balance sheet at the date of takeover,according to the acquisition method per SFAS 141(R) and the purchase method per SFAS 141?

A) Entry A

B) Entry B

C) Entry C

D) Entry D

E) Entry E

Correct Answer:

Verified

Q3: What is the dollar amount of non-controlling

Q4: What amount of excess land allocation would

Q5: What is the total amount of goodwill

Q6: Kordel Inc.holds 75% of the outstanding common

Q7: What amount should have been reported for

Q9: In consolidation,the total amount of expenses related

Q10: What amount of goodwill should be attributed

Q11: Femur Co. acquired 70% of the voting

Q12: What amount of goodwill should be attributed

Q13: The non-controlling interest's share shown on Denber's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents