REFERENCE: Ref.03_07

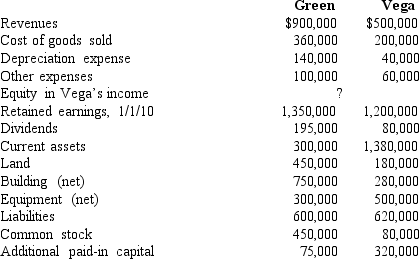

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the book value of Vega at January 1,2006.

A) $997,500.

B) $857,500.

C) $1,200,000.

D) $1,600,000.

E) $827,500.

Correct Answer:

Verified

Q30: Under the initial value method, when accounting

Q36: Melvin Company applies the equity method to

Q38: REFERENCE: Ref.03_04

Jans Inc.acquired all of the outstanding

Q39: Which of the following statements is false

Q40: According to SFAS 142,which of the following

Q42: REFERENCE: Ref.03_07

Following are selected accounts for Green

Q43: REFERENCE: Ref.03_05

Perry Company obtains 100% of the

Q44: REFERENCE: Ref.03_06

Kaye Company acquired 100% of Fiore

Q45: REFERENCE: Ref.03_05

Perry Company obtains 100% of the

Q46: Kaye Company acquired 100% of Fiore Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents