REFERENCE: Ref.03_07

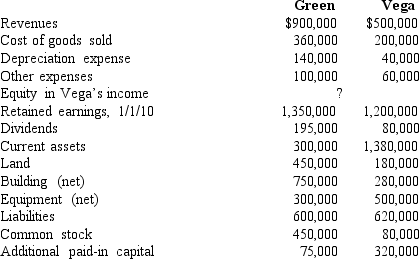

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated common stock.

A) $450,000.

B) $530,000.

C) $555,000.

D) $635,000.

E) $525,000.

Correct Answer:

Verified

Q57: Kaye Company acquired 100% of Fiore Company

Q58: REFERENCE: Ref.03_07

Following are selected accounts for Green

Q59: REFERENCE: Ref.03_06

Kaye Company acquired 100% of Fiore

Q60: REFERENCE: Ref.03_07

Following are selected accounts for Green

Q63: One company acquires another company in a

Q63: REFERENCE: Ref.03_07

Following are selected accounts for Green

Q64: REFERENCE: Ref.03_10

Beatty,Inc.acquires 100% of the voting stock

Q66: REFERENCE: Ref.03_10

Beatty,Inc.acquires 100% of the voting stock

Q66: How is the fair value allocation of

Q73: When is a goodwill impairment loss recognized?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents