REFERENCE: Ref.03_12 Watkins,Inc.acquires All of the Outstanding Stock of Glen Corporation on Corporation

REFERENCE: Ref.03_12

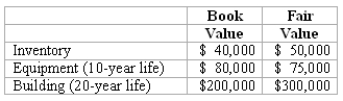

Watkins,Inc.acquires all of the outstanding stock of Glen Corporation on January 1,2009.At that date,Glen owns only three assets and has no liabilities:

-If Watkins pays $450,000 in cash for Glen,what allocation should be assigned to the subsidiary's Equipment in preparing for consolidation at December 31,2011,assuming the book value at that date is still $80,000?

A) $(5,000) .

B) $80,000.

C) $75,000.

D) $73,500.

E) $(3,500) .

Correct Answer:

Verified

Q72: Prince Company acquires Duchess, Inc. on January

Q89: REFERENCE: Ref.03_12

Watkins,Inc.acquires all of the outstanding stock

Q90: REFERENCE: Ref.03_12

Watkins,Inc.acquires all of the outstanding stock

Q92: For an acquisition when the subsidiary retains

Q96: REFERENCE: Ref.03_12

Watkins,Inc.acquires all of the outstanding stock

Q97: What accounting method requires a subsidiary to

Q103: For an acquisition when the subsidiary maintains

Q113: What is the partial equity method? How

Q114: From which methods can a parent choose

Q119: For an acquisition when the subsidiary retains

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents