REFERENCE: Ref.03_12 Watkins,Inc.acquires All of the Outstanding Stock of Glen Corporation on Corporation

REFERENCE: Ref.03_12

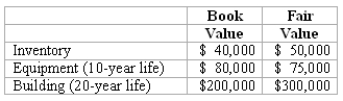

Watkins,Inc.acquires all of the outstanding stock of Glen Corporation on January 1,2009.At that date,Glen owns only three assets and has no liabilities:

-If the transaction instead occurred on January 1,2008 under a SFAS 141 purchase combination,and Watkins pays $300,000 in cash for Glen,at what amount would the subsidiary's Equipment be represented in a December 31,2011 consolidation?

A) $48,000.

B) $50,000.

C) $52,000.

D) $77,000.

E) $80,000.

Correct Answer:

Verified

Q72: Prince Company acquires Duchess, Inc. on January

Q76: One company acquires another company in a

Q80: REFERENCE: Ref.03_08

Goehler,Inc.acquires all of the voting stock

Q81: REFERENCE: Ref.03_12

Watkins,Inc.acquires all of the outstanding stock

Q83: Consolidations subsequent to the date of combination

Q85: REFERENCE: Ref.03_12

Watkins,Inc.acquires all of the outstanding stock

Q89: REFERENCE: Ref.03_12

Watkins,Inc.acquires all of the outstanding stock

Q97: What advantages might push-down accounting offer for

Q110: What is the basic objective of all

Q119: For an acquisition when the subsidiary retains

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents