REFERENCE: Ref.03_14

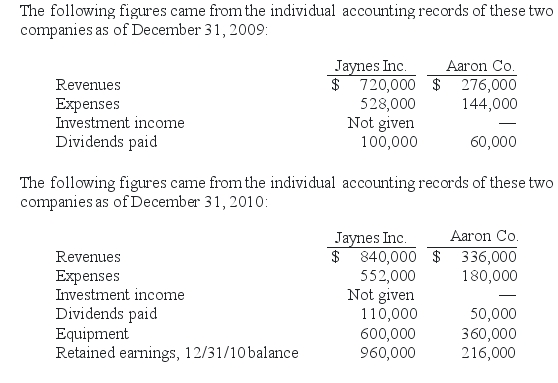

Jaynes Inc.obtained all of Aaron Co.'s common stock on January 1,2009,by issuing 11,000 shares of $1 par value common stock.Jaynes' shares had a $17 per share fair value.On that date,Aaron reported a net book value of $120,000.However,its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records.Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

SHAPE \* MERGEFORMAT

-If this combination is viewed as an acquisition,what was consolidated patents as of December 31,2010?

Correct Answer:

Verified

Q95: Yules Co. acquired Noel Co. in an

Q99: REFERENCE: Ref.03_12

Watkins,Inc.acquires all of the outstanding stock

Q102: REFERENCE: Ref.03_15

Utah Inc.obtained all of the outstanding

Q103: Carnes Co.decided to use the partial equity

Q105: On January 1,2009,Jumper Co.acquired all of the

Q107: REFERENCE: Ref.03_14

Jaynes Inc.obtained all of Aaron Co.'s

Q108: REFERENCE: Ref.03_16

Pritchett Company recently acquired three businesses,recognizing

Q109: Which of Pritchett's reporting units require both

Q114: Figure:

On 4/1/09, Sey Mold Corporation acquired 100%

Q115: Why is push-down accounting a popular internal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents