REFERENCE: Ref.03_15

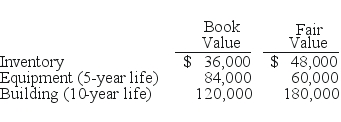

Utah Inc.obtained all of the outstanding common stock of Trimmer Corp.on January 1,2009.At that date,Trimmer owned only three assets and had no liabilities:

SHAPE \* MERGEFORMAT

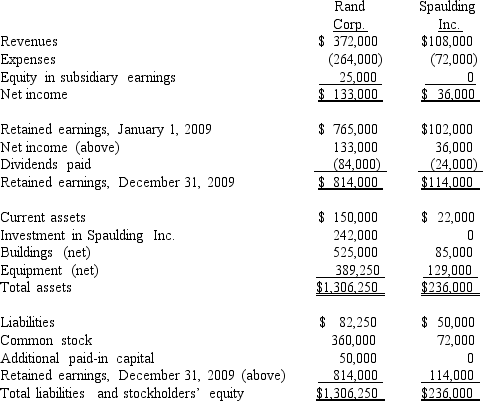

-On January 1,2009,Rand Corp.issued shares of its common stock for all of the outstanding common stock of Spaulding Inc.This combination was accounted for as a purchase.Spaulding's book value was only $140,000 at the time,but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share.Rand was willing to convey these shares because it felt that buildings (ten-year life)were undervalued on Spaulding's records by $60,000 while equipment (five-year life)was undervalued by $25,000.Any excess cost over fair value is assigned to goodwill.

Following are the individual financial records for these two companies for the year ended December 31,2009.

Required:

Prepare a consolidation worksheet for this business combination.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q107: An acquisition transaction results in $90,000 of

Q109: Avery Company acquires Billings Company in a

Q109: Figure:

On 4/1/09, Sey Mold Corporation acquired 100%

Q112: Utah Inc. acquired all of the

Q112: REFERENCE: Ref.03_14

Jaynes Inc.obtained all of Aaron Co.'s

Q114: REFERENCE: Ref.03_15

Utah Inc.obtained all of the outstanding

Q115: REFERENCE: Ref.03_13

Fesler Inc.acquired all of the outstanding

Q119: REFERENCE: Ref.03_13

Fesler Inc.acquired all of the outstanding

Q120: REFERENCE: Ref.03_14

Jaynes Inc.obtained all of Aaron Co.'s

Q122: For each of the following situations,select the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents