REFERENCE: Ref.02_01 Bullen Inc.assumed 100% Control Over Vicker Inc.on January 1,20X1.The Book

REFERENCE: Ref.02_01

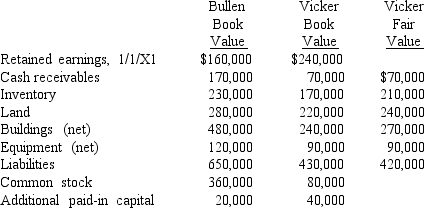

Bullen Inc.assumed 100% control over Vicker Inc.on January 1,20X1.The book value and fair value of Vicker's accounts on that date (prior to creating the combination) follow,along with the book value of Bullen's accounts:

-Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $42 fair value for all of the outstanding shares of Vicker.What will be the consolidated Additional Paid-In Capital and Retained Earnings (January 1,20X1 balances) as a result of this transaction (which is not a pooling of interests) ?

A) $20,000 and $160,000.

B) $20,000 and $260,000.

C) $380,000 and $160,000.

D) $464,000 and $160,000.

E) $380,000 and $260,000.

Correct Answer:

Verified

Q5: Direct combination costs and stock issuance costs

Q6: Which one of the following is a

Q7: In a pooling of interests,

A)revenues and expenses

Q7: A statutory merger is a(n)

A) business combination

Q9: Which one of the following is a

Q11: REFERENCE: Ref.02_01

Bullen Inc.assumed 100% control over Vicker

Q12: Figure:

Bullen Inc. acquired 100% of the

Q13: According to SFAS No.141,the pooling of interest

Q14: Using the purchase method,goodwill is generally defined

Q19: What is the primary accounting difference between

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents