REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

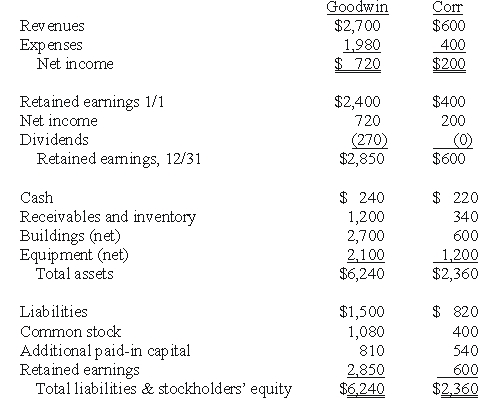

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assuming the combination is accounted for as a purchase,compute the consolidated goodwill account at December 31,20X1.

A) $0.

B) $100.

C) $125.

D) $160.

E) $45.

Correct Answer:

Verified

Q6: At the date of an acquisition which

Q15: Lisa Co. paid cash for all of

Q20: REFERENCE: Ref.02_01

Bullen Inc.assumed 100% control over Vicker

Q21: REFERENCE: Ref.02_02

Prior to being united in a

Q21: Figure:

The financial statements for Goodwin, Inc., and

Q24: In a transaction accounted for using the

Q25: In a transaction accounted for using the

Q27: REFERENCE: Ref.02_03

The financial statements for Goodwin,Inc. ,and

Q36: Figure:

The financial statements for Goodwin, Inc., and

Q40: Figure:

The financial statements for Goodwin, Inc., and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents