REFERENCE: Ref.02_04 on January 1,20X1,the Moody Company Entered into a Transaction for Transaction

REFERENCE: Ref.02_04

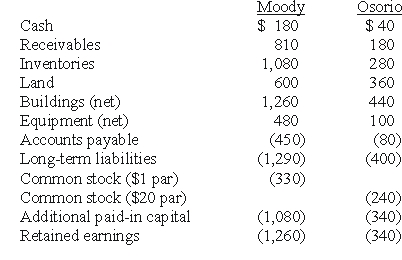

On January 1,20X1,the Moody company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this purchase.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-Compute the amount of consolidated additional paid-in capital at date of combination.

A) $1,080.

B) $1,420.

C) $1,065.

D) $1,425.

E) $1,440.

Correct Answer:

Verified

Q22: Figure:

The financial statements for Goodwin, Inc., and

Q40: REFERENCE: Ref.02_03

The financial statements for Goodwin,Inc. ,and

Q40: Which of the following statements is true

Q42: REFERENCE: Ref.02_04

On January 1,20X1,the Moody company entered

Q43: REFERENCE: Ref.02_06

The financial balances for the Atwood

Q45: REFERENCE: Ref.02_04

On January 1,20X1,the Moody company entered

Q46: REFERENCE: Ref.02_05

Carnes has the following account balances

Q47: REFERENCE: Ref.02_06

The financial balances for the Atwood

Q49: REFERENCE: Ref.02_03

The financial statements for Goodwin,Inc. ,and

Q56: Compute the amount of consolidated common stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents